Pattern of Negligent Activity by Financial Institution or Non-Financial Trade or Business Negligent Violation by Financial Institution or Non-Financial Trade or Business

#F BAR TAXES CODE#

Code citationįoreign Financial Agency Transaction – Non-Willful Violation of Transactionįoreign Financial Agency Transaction – Willful Violation of Transaction In addition, a failure to file a FBAR report may result in exposure to civil penalties, including up to half of the balance in all unreported accounts if the government determines that the failure to report was willful or reckless.Ĭurrent penalties (adjusted for inflation) are as follows: U.S. For several years, the IRS has publicly touted its intention to strongly enforce the FBAR reporting requirements. the aggregate value of those foreign financial accounts exceeded $10,000 at any time during the calendar year reported.Ī failure to file a FBAR report may result in criminal exposure-that is, the possibility of a criminal indictment or investigation.a financial interest in or signature or other authority over at least one financial account located outside the United States if.

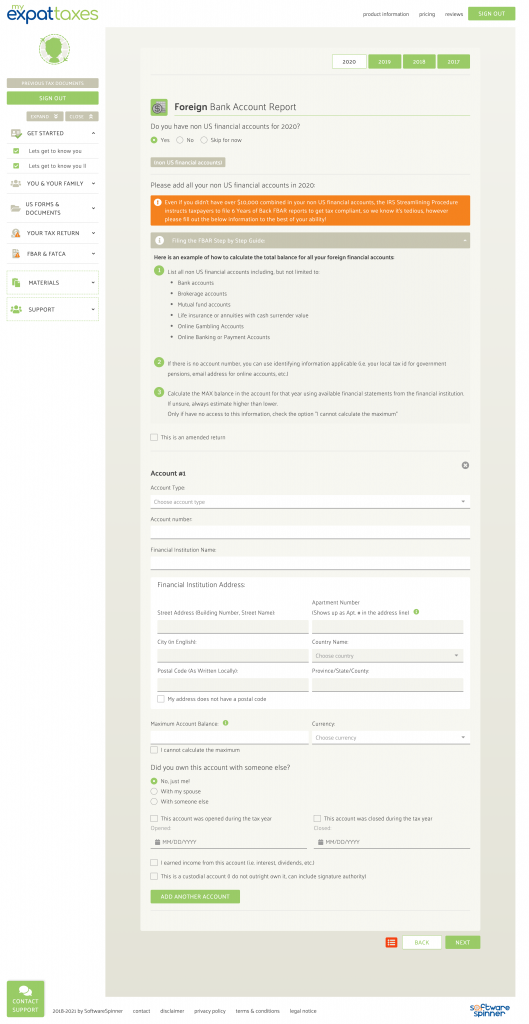

The FBAR regulations require that a United States person, including a citizen, resident, corporation, partnership, limited liability company, trust and estate, file an FBAR to report: While FinCEN retains rule-making authority with respect to FBAR reporting, FinCEN redelegated civil FBAR enforcement authority to the IRS. IRS Criminal Investigation (CI), however, maintains authority to enforce the criminal provisions of the BSA. The Secretary of the Treasury subsequently delegated the authority to administer civil compliance with Title II of the BSA to the Director of FinCEN. Report of Foreign Bank and Financial Accounts (FBAR)Ĭongress enacted the statutory basis for the requirement to report foreign bank and financial accounts in 1970 as part of the “Currency and Foreign Transactions Reporting Act of 1970,” which came to be known as the “Bank Secrecy Act” or “BSA.” These anti-money laundering and currency reporting provisions, as amended, were codified at – 5332, excluding section 5315.

0 kommentar(er)

0 kommentar(er)